Monmouth Real Estate (MNR) - Tales From The Tape

-

-

- Monmouth is likely to report another loss on its securities portfolio this quarter.

- Reliance on dividend income from REITs is 17% of FFO - that's high.

- MNR is funding growth with 6.125% preferreds - that's expensive.

- Are preferred investors aware of the risk?

-

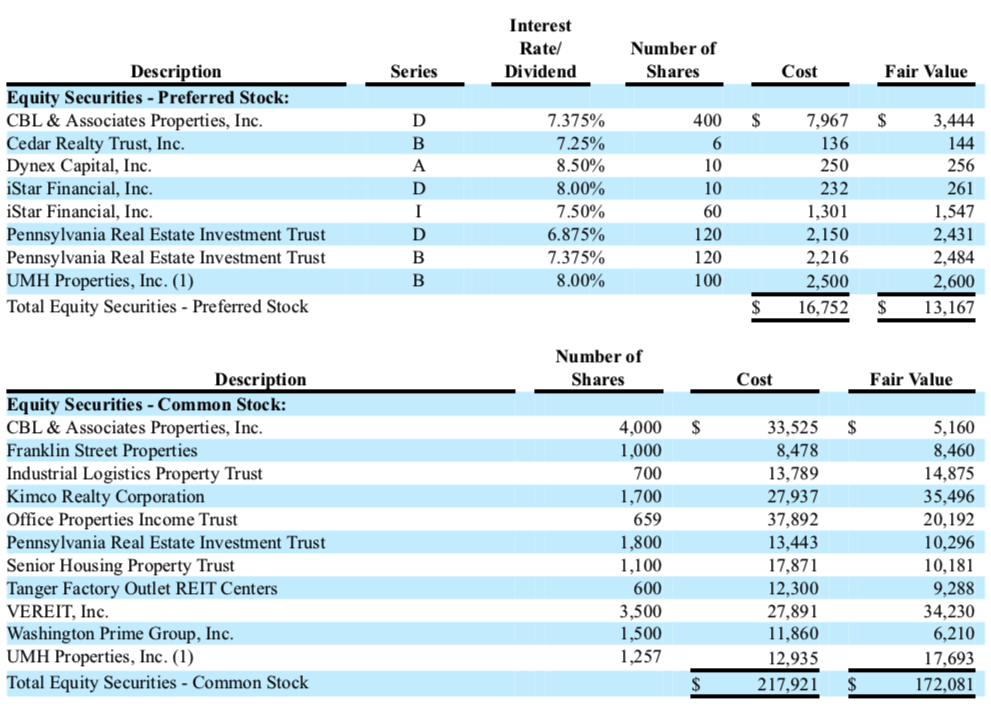

The risky part of the story is MNR's REIT securities portfolio, which is summarized below. Based on market declines since year end, MNR is likely to report a hit to fair market values, which totaled $182 million at 12/31/19. You'd be hard pressed to find a scarier portfolio at the moment - CBL, PEI, SKT, WPG - but also fortunate gains in KIM and VER. Management has stated a desire for this portfolio to be less than 5% of assets and the market is assisting in that effort.

A snapshot of the REIT securities portfolio from MNR's 2019 10-K is below (fiscal year ends 9/30/19). There were no sales during the quarter ending 12/31/19 so the list might still be current.

The securities portfolio was worth $1.86/share at 12/31/19, representing approximately 12.8% of MNR's closing stock price of $14.48/share. Given the outsized yields on many of these securities, dividend income was $3.2 million in the latest quarter, representing about 17% of FFO. We already know that WPG has cut their dividend by 50% for 2020, which is going to be a $750K hit to annual cash flow based on the holding of 1.5 million WPG common shares. The recent 90% dividend cut by Pennsylvania REIT will also reduce cash flow by $1.4 million on an annualized basis.

You'd be hard pressed to find a more diverse investment strategy - long-term FedEx leases and 4 million shares of CBL common. While it's easy enough to haircut particular securities from NAV, it's not so easy to zero out the decision-making behind these investments.

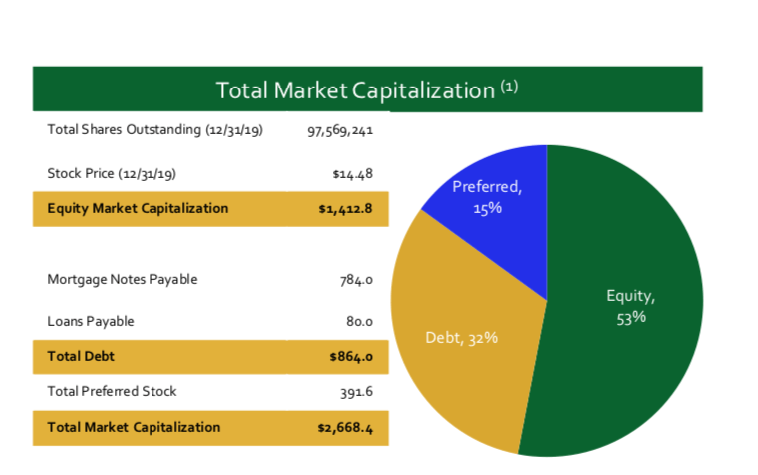

Source: Monmouth Realty February 2020 Investor Presentation

Investors should also be concerned about the increasing use of preferred stock to fund growth (see above table). MNR has a single preferred issue, the 6.125% Series C. MNR originally sold 5.4 milion shares of the Series C in 2016 for gross proceeds of approximately of $135 million. Since then, the issue has ballooned to 15.7 million shares with a redemption value of $392 million. Much of the growth has come from using at-the-market (ATM) offerings to push out additional shares, including $43 million sold in the quarter ending 12/31/19. Funding growth at 6.125% is an expensive way to run a company, and begs the question of why MNR wasn't issuing common stock at a time when industrial REIT stock prices were in a strong rally.

Given the significant swings in market prices over the last month, we have no opinion on the relative value of MNR-C preferred. What we can say if that investors should look at the yields currently available on the Public Storage (PSA) group of preferred securities to get an idea of the 'risk free' rate in preferreds. Fixed-charge coverage for PSA was a robust 6.9x for 2019, demonstrating the high levels of safety for PSA's preferred investors. In contrast, fixed-charge coverage for MNR was about 2.0x for the most recent quarter, including similar adjustments for capital expenditures and straight-line rent. That's still adequate, but another leg up in preferred funding is going to put MNR in a more challenged coverage position.

Bottom line - the strength of MNR's industrial lease stream provides good protection in a tough economy. However, weaker coverage metrics and cash flow losses from the securities portfolio need to be taken into account, particularly if the economic trough isn't the June quarter.

03/16/2020