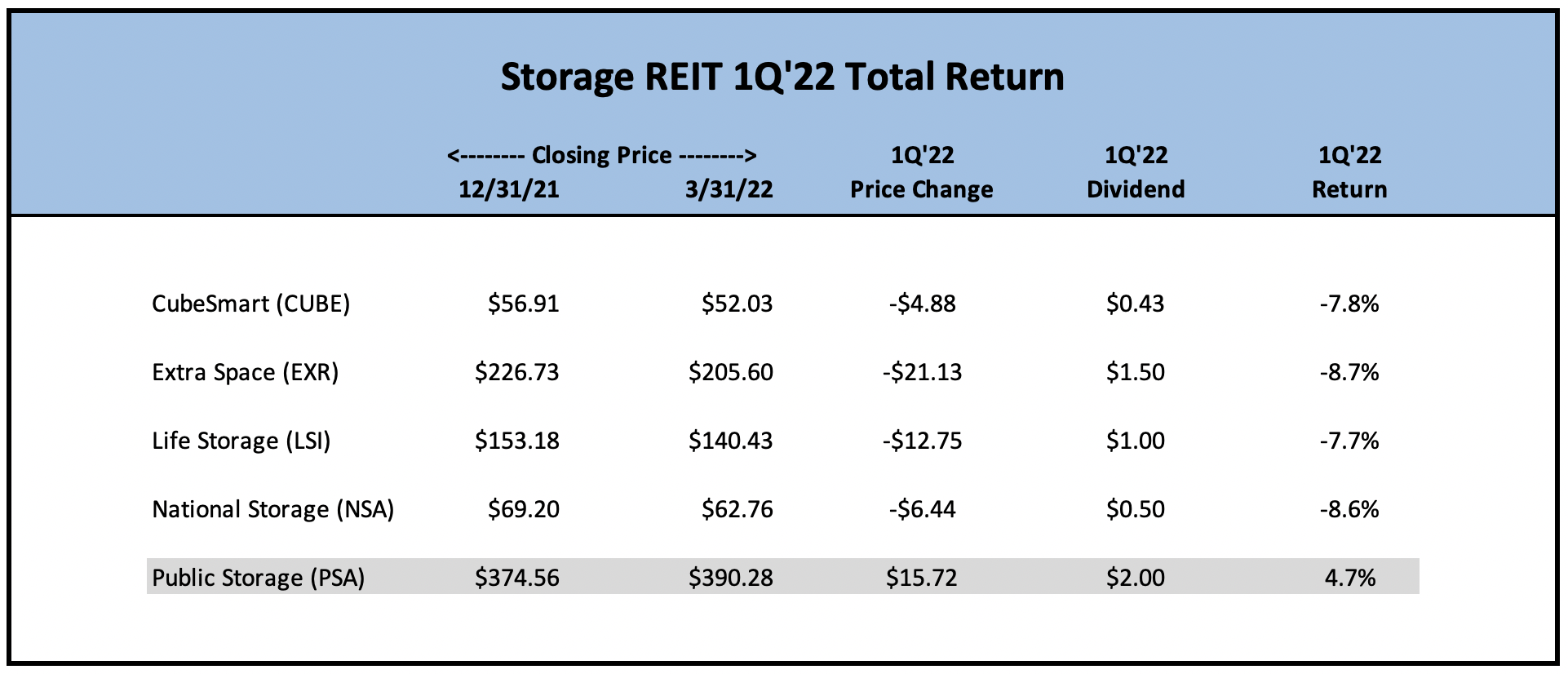

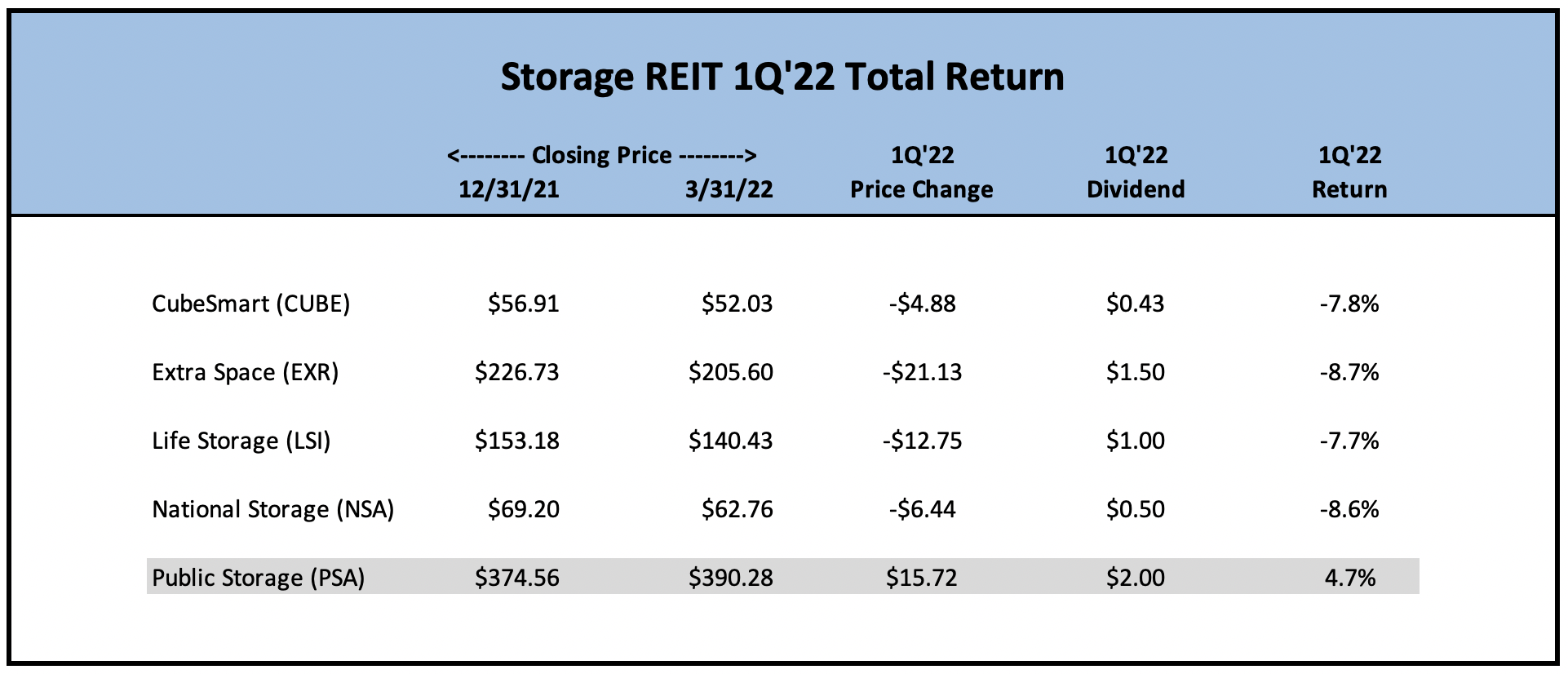

Public Storage (PSA) leads sector in 1Q'22 returns.

The storage REIT sector posted strong returns in 2021, so it's perhaps not surprising that 1Q'22 stock prices have taken a breather. But as outlined below, Public Storage (PSA) achieved a 4.7% total return in 1Q'22, outpacing the approximate 8% losses for the rest of the group. Why the outperformance?

While it's still early in the year, we think PSA has a number of advantages for outperformance. First of all, PSA has more to gain than its competitors from the easing of restrictions on rental rate increases, particularly in California. PSA also has a greater proportion of pre-stabilized properties (approximately 25% of the portfolio), which should provide outsized NOI increases as these properties mature over the next 1-3 years. Lastly, PSA is still in the middle innings of putting a substantial amount of excess equity capital to work. We wouldn't be surprised to see PSA acquire $1-$2 billion of properties in 2022 without needing to issue common equity.

All of the five storage REITs are expected to post strong results in 2022. Initial guidance calls for an average increase of 16.4% in Core FFO/share based on continuation of last year's gains in rental rates. But as it becomes more difficult to push through outsized rate increases, factors such as balance sheet capacity, portfolio composition, and market variance will play a greater role.![]()

![]()

While it's still early in the year, we think PSA has a number of advantages for outperformance. First of all, PSA has more to gain than its competitors from the easing of restrictions on rental rate increases, particularly in California. PSA also has a greater proportion of pre-stabilized properties (approximately 25% of the portfolio), which should provide outsized NOI increases as these properties mature over the next 1-3 years. Lastly, PSA is still in the middle innings of putting a substantial amount of excess equity capital to work. We wouldn't be surprised to see PSA acquire $1-$2 billion of properties in 2022 without needing to issue common equity.

All of the five storage REITs are expected to post strong results in 2022. Initial guidance calls for an average increase of 16.4% in Core FFO/share based on continuation of last year's gains in rental rates. But as it becomes more difficult to push through outsized rate increases, factors such as balance sheet capacity, portfolio composition, and market variance will play a greater role.

04/01/2022